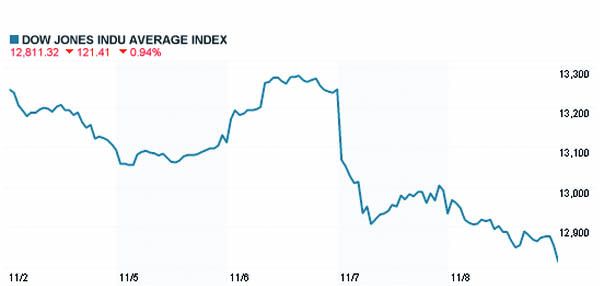

Following Obama’s re-election on Tuesday, the Dow Jones dropped 3.3%, the largest two-session loss this year. Whether or not stock traders would have reacted similarly to a Romney victory is unknowable. What has been the prevailing notion of many in the financial industry, however, is a general skepticism of Washington lawmakers to come together and solve the fiscal cliff problem.

Should Congress be unable to avoid ‘fiscal tightening’ by the end of the year, the CBO predicted in a report,

“[I]f all of that fiscal tightening occurs, real (inflation-adjusted) gross domestic product (GDP) will drop by 0.5 percent in 2013...Output would be greater and unemployment lower in the next few years if some or all of the fiscal tightening scheduled under current law—sometimes called the fiscal cliff—was removed. However, CBO expects that even if all of the fiscal tightening was eliminated, the economy would remain below its potential and the unemployment rate would remain higher than usual for some time. ”

This 'tightening' resulting from the fiscal cliff would also result in a temporary jump in unemployment back up to 9.1% before falling back down to 5.5% by 2018.

The prospect of another, although minor, recession has spurred investors to pull some funds out of the market. Coupled with grim news out of Europe, the European Commission revised growth forecasts in the Eurozone from 1% down to 0.1%. Both of these factors seemingly overrode very positive news on the US economy specifically. A department of labor report showed the number of individuals claiming unemployment declined by 8,000 and and the US' trade deficit reached a two year low.

If Congress shows little progress on the issue between now and January 1st 2013, it is very likely that the markets will slip even further into the red. Confidence is key to encouraging investment and, as of now, traders have little of it in both Democrats and Republicans to reach an agreement.

Republican Speaker of the House, John Boehner and Senate Majority Leader Harry Reid, a Democrat, have both issued statements pledging a bipartisan approach to restore confidence in not only the US economy, but in government as well.

Wall Street’s optimism of a quick and effective tax reform solution is shaky at best, but there exists no other option for Washington lawmakers since Congress remains divided between the House and Senate.