A few weeks ago we witnessed in disbelief the seductress of reality tv Kim Kardashian swap her greased and puckered internet-breaking social media posts for an austere and fully-clothed Oval Office photo op with President Trump in her new role as hot celebrity prison broker.

And yet again, in a stranger-than-fiction redux last week, we did a double take as tatted and pierced former NBA bad boy Dennis Rodman, in MAGA cap and pot cryptocurrency T, got all ferklempt on CNN as he relayed how being BFF Kim Jong Un’s unofficial North Korean consigliere helped the historic POTUS meet-and-greet happen.

https://www.youtube.com/watch?v=dAJLJRRJY3E

SNL script writers couldn’t dream this fairy dust up. The truth can’t get any weirder than this, right? But it can.

Sacramento Has Lobotomized California

If you really want to suspend reality, just look to the land of make believe, movie stars and Democratic supermajorities: California. From the latest gas tax hike to Governor Moon Beam’s recent water-restriction bills, the Left Coast’s legislative whackadoodlery reads like an Onion article. And while it appears that Sacramento has frontally lobotomized the entire state’s common sense for good, don’t underestimate the human capacity for change (just look at Kim K and Rodman) . Not all California constituents are fiscal and regulatory masochists, and they’re getting fed up footing the bill for the asylum.

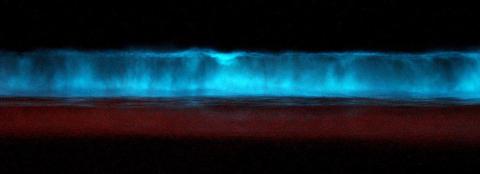

Indeed, come November, the latest political developments may possibly turn the Democrats self-touted “blue wave” into, dare I say, a bit of a red tide.

In news most CA residents initially thought was the work of some vitamin-D-deprived tech geeks holed up in a smelly Moscow back office on laptops, was in actuality the Governor signing two bills into law making it illegal for Californians to jump in the shower and throw in a load of dirty clothes on the same day. Specifically, AB1668 and SB 606 will limit individuals indoor daily water usage to 55 gallons in 2022, and then 50 gallons per day per person by 2030.

To put this water rationing into perspective where I live in San Diego, in January and February of last year, a good amount of rainfall led residents to turn off their sprinklers and cause the Santa Fe Irrigation District water sales to hit a 10-year low. Division 3 SFID Director Marlene King has noted that District staff calculated Jan. ’17 usage at 123 gallons per capita per day, and Feb. ’17 at 127 g/p/c/d. This usage doesn’t come close to the Governor’s targets, and this was when we actually could bust out our best Mary Poppins and throw around an umbrella for the brief thrill of novelty. SFID water usage stratosphered in April, with residents consuming 396 gallons per capita per day.

These targets are more out of touch than the Governor’s bullet train. Sacramento is so deluded in its smug government-knows-best demagoguery that it thinks constituents are stupid enough to forget they reside next to a large body of water called the Pacific Ocean. I’m all for conserving precious resources like water, but CA Democrats are so stuck on slapping another tax or fine on whom they deem environmentally deplorable (essentially the entire CA populace), they’ve forgotten about supply.

New Water Management Needed

Instead of liposuctioning another pound of flesh off an electorate that’s already had their funds surgically removed by the CA Franchise Tax Board and their County Treasurer, why not focus on how we can get more water or at least improve its management. Most of the water that falls on or runs through this state is never collected for use by households. So one of the least guilty culprits of state water usage are getting fiscally hosed, while legislators could be making better use of water transfer conveyance, water capture and storage, recycled water, and desalinating that bottomless monster truck Big Gulp of salty water beyond the beach. But then again, this is the Republic of California, where politicians figure, why waste time on these options or finding alternative sources of income when they've got sun-worshipping tax-glutton suckers like us.

Once 2022 hits the fan and water districts don’t meet their targets, Brown’s new laws enable the State Water Resources Control Board to slap an $1,000 dollar a day penalty on them. And just like any other extra company cost, the consumer ends up eating it. This is no different. A District cost recovery provision allows for water purveyors to fine individual users for breaking Governor Brown’s new law. With indoor usage restrictions up and running, just imagine the possibilities when the Governor starts setting outdoor targets for how long you’re watering the gladiolas.

About That Gas Tax

You’d think Sacramento had learned its lesson from its lead balloon of a gas tax hike bill. That went over reaaaaaally well, just ask Orange County Senator Josh Newman (D-Fullerton). Mr. Newman signed his political death sentence when he voted “yes” to Senate Bill 1, which will dump some more taxes on the overinsured over-tolled car owner by adding 12.5 cents a gallon to gas and 20 cents to diesel. Oh, and then there’s some fun extra vehicle fees to shell out for each year, which jump from between $25 to $175 depending on whether you’ve got a bargain basement clunker or a Swarovski-encrusted Maybach. The nerve! This from a state that has THE highest average regular gas price in the country. So on June 5th voters in his district exercised their democratic liberties and for the first time in 25 years recalled a Senator from office by 59.5%. BOOM. I guess that gas tax really was the fuel to fire tax payers up.

Voters elected Republican Ling Ling Chang to replace Mr. Newman, costing the Democrats their two-thirds supermajority required to raise taxes. In one of the highest taxed, over regulated states in the nation, this is unicorn-level magic. To the 80 other legislators who voted for the gas tax hike, some quiet introspection and personal political evolution may be required here. Namaste. Especially since Reform California Founder, Carl DeMaio, smells blood and is considering recall campaigns for other gas-tax-hike signatories.

Republicans have hit a nerve, been thrown a juicy bone and are running with it. Literally. There is already a gas tax repeal initiative in the works, which required 585,407 signatures from registered voters to qualify for the November ballot, and supporters recently submitted petitions signed by 963,905 people. Election officials need to verify all signatures, but have already found 77% of those assessed to be valid.

Cox/Newsom Race For Governor

Midwestern-raised Republican gubernatorial “Clean Out the Barn” candidate, John Cox, tapped into this visceral voter tax fatigue and is now on the November ballot to duke it out with the ever-coiffed San Fran-born-and-raised Brown sidekick, Lt. Gov. Gavin Newsom. All you need to know is that Newson is Gov Brown’s right-hand man, and wants to slip his manicured hands in your pocket and take off with with your wallet. In contrast, in almost every stump speech, Mr. Cox has bemoaned the state’s middle-class squeeze, made sure voters knew he co-chairs the gas tax repeal effort and promised come November, "hardworking Californians wouldn’t have to choose between buying groceries or filling up their tank on their way to work.”

The LA Times acknowledged that other candidates who took strong public positions against the gas tax benefited as a result, such as relatively unknown Republican Assemblyman Travis Allen from Huntington Beach, who placed fourth in the Governor’s race above well-known Democrat state Treasurer John Chiang. In key congressional districts where Republicans currently have an edge over their opponents, it would inure to their benefit to keep banging on about all this taxation without representation. It’s resonating. Big time.

Parties Are Clear On Taxes

Tax Fatigue is not blue or red. It just so happens in this period of political history higher taxes are associated with Democrats and lower taxes with Republicans.

Voters must always remember that historically some of the biggest, baddest opponents of an open, less-burdened, less-regulated, less-taxed economy are from the right. Just look at frenemy Bob Dole’s record in the eighties. One of the best lines came from Jack Kemp, who quipped, “Bob Dole never met a tax he didn’t hike.” And then it’s important to recall that some of the most iconic figures in the Democratic party voted for one of the largest income tax cuts in this country’s history; and not just Kennedy’s, but Ronald Reagan’s Tax Reform Act of 1986, which cut the highest marginal tax rate from 50% to 28%, closed loopholes, shelters and deductions for the wealthy and created enterprise zones which exempted millions of low-income families from paying federal income taxes.

The Act swept through the Democrat-controlled Congress and passed the Senate 97 to 3 with support from — wait for it — Ted Kennedy, Al Gore, Chuck Schumer, Barbara Boxer, Joe Biden, Bill Bradley, and Harry Reid. This gold list is like legal-extortion-covered candy. It doesn’t get any sweeter than this.

Once upon a time even Governor Brown was considered a fiscal conservative. And when he ran for President, my father helped him shape his flat-tax platform. Recently, while giving testimony to lawmakers regarding the gas tax bill, even the Governor recognized there could be political fallout for his and other Democrats support of it, admitting “the ghost of Howard Jarvis still haunts the halls of this Capitol…He’s had quite an influence, that guy.” Governor Brown was clearly alluding to the widespread popularity amongst California voters of Howard Jarvis’s landmark property tax constitutional amendment, Prop 13, which the former spit razor blades about in vain. Just like the gas tax hike, the endless rise in property taxes were seen as yet another attack on hard-working, middle-class constituents, who were barely treading water in a deluge of tariffs.

History Repeating Itself?

Indeed, Governor Brown knows all too well that a California Governor preceding him rode the wave of the popular Prop 13 and cowabunga’d right into the Oval Office. The Reagan realignment chipped away at the Democrats’ core base by making the appeal for tax cuts and a better quality of life. And in a Democrat-controlled state that has the nation’s highest effective poverty rate, an affordable housing crisis, and an out-of-control homeless issue, it’s hard not to consider that this gas tax and the Governor’s new water restrictions have caused moderate Democrats and independents residing in California to reconsider their electoral options in November.

One would think that Democrats would be struck by a “come to Jesus” moment, and consider toning down their failure-to-tax-fire-and-brimstone rhetoric to appeal beyond their base. Indeed, one of the reoccurring headlines as of late is the possible independent voter effect on November outcomes. In a recent release published by Political Data Inc., the company found that independents have surpassed Republicans by 73,000 registrants to become the second-largest voting bloc in California, which has 19 million registered voters in total.

So, if Democrats won’t join the anti-tax crusade, Republicans are going to have to get moderate liberals and independents to beat them. The running joke is that the only people left in California are the super rich and the homeless. If the Republicans don’t succeed, this punchline might not be much of a laughing matter. Indeed, in swing districts Republican candidates are targeting independents and Democrat-lite voters who feel overburdened, underserved and/or abandoned by their out-of-touch party.

Truth really is stranger than fiction, because, as the saying goes, "fiction is obliged to stick to possibilities; Truth isn’t.”And boy is that the case when it comes to California and all the fantastical ways Sacramento has tried to squeeze its taxpayers.

The human capacity to reinvent is alive and well in this absurd world of ours. And even though the Democrats think they’ve got California sussed, they shouldn’t underestimate the possibility of this electorate’s evolution.

Lest we forget, California is not just the birthplace of Disney, but Reagan too.

Rachel Laffer worked with Prime Minister Margaret Thatcher in London and other prominent politicians, such as Congressman Joseph P. Kennedy II on Capitol Hill. She went on to work in New York and Belgium as an editor and writer for the Wall Street Journal Editorial Page. She currently resides in San Diego and works with her brother and father at Laffer Associates, an economic consulting and research firm. She is also the editor of the RSFPost.com