The point of electing Centrist Independents is to empower the political center, to build a bridge between Republicans and Democrats, and to get things done.

As I’ve written before in our Finding Common Ground series, there are a host of issues on which Centrist Independents could be the catalyst for productive legislation: infrastructure, health care reform, even gun policy.

But there are also times when a handful of Centrist Independents might play a crucial role in stopping a legislative train wreck. The Republican tax plan under consideration right now is one of those runaway trains.

The Republican tax plan is fiscal heroin: it feels great now and will wreak havoc in the future.

The Committee for a Responsible Budget, a bipartisan budget watchdog group, says the current proposal would cost the federal government between $3 and $7 trillion in lost revenue over a decade and that “no plausible amount of economic growth would be able to pay for a substantial portion of the tax plan, let alone reduce deficits.”

America’s debt is already on an unsustainable trajectory. Even before the Republican tax proposal, the nation’s borrowing was projected to grow to the highest level relative to GDP in history. The nonpartisan Congressional Budget Office warned in a report earlier this year: “The prospect of such large and growing debt poses substantial risks for the nation and presents policymakers with significant challenges.”

Remember, that was before the Republicans floated their wildly irresponsible tax plan.

The best way to get out of our fiscal hole would be to stop digging. The Republican tax plan would lower a backhoe into our current fiscal crevasse to begin digging faster and deeper.

Remarkably, the Democrats are opposing the tax bill not because it would be fiscally disastrous, but because it is too generous to the wealthy. The current Democratic commentary suggests that the tax cuts — which will have to be paid back in some way by future generations— would be just fine if they were tilted more toward working people.

NO.

Everybody likes tax cuts. I would like a pony and a new car, too. The reality is that the federal government is not in a position to offer any of those things. The Republicans have now abandoned any pretense of being the party of fiscal discipline. The Democrats have not tried to lay claim that mantle since Bill Clinton balanced the budget in the 1990s.

How could Centrists help? By injecting some fiscal responsibility back into the discussion. That is one of the core principles of the Centrist Project and of all of the Independent candidates whom we endorse.

A Centrist Caucus in the U.S. Senate — just a few Independent U.S. senators with a genuine devotion to fiscal reform — could steer the discussion where it needs to go: reforming the tax code and curtailing entitlement growth.

There is a crucial distinction between tax cuts and tax reform. Tax cuts mean more money for you and less for the government. That would be wonderful — if the federal government had sufficient revenue to pay our bills without borrowing from China.

A tax cut now is like a family deciding they would like to take more vacations and go out to dinner more often. That would be lovely. But if they can’t generate more income, or cut spending on other things, it just means more charges on the Visa. That’s not a budget strategy; it’s fiscal recklessness.

Tax reform, on the other hand, is about making the tax code less distortionary. Every tax does two things: it raises revenue and it changes behavior. If we tax smoking, some people will smoke less. If we tax income, some people will work less. Obviously the former is much better for the country than the latter.

As I’ve written before, tax reform is about purging the tax code of inefficient loopholes and incentives. The best example of this kind of reform was the bipartisan tax reform of 1986, which broadened and simplified the tax system in a revenue neutral way (without bringing in more or less total revenue). The tax code needs this kind of reform again. The Centrist Caucus could lead this kind of process.

At the same time, neither Social Security nor Medicare is solvent in the long run. If Democrats want to protect these programs, they need to fix them. If Republicans want lower taxes, they need to lower the growth in entitlement spending. This, too, is a discussion the Centrist Caucus could jumpstart. Republicans and Democrats are afraid to touch these hard subjects.

Centrist Independents are not afraid to make hard budget decisions, as Centrist Independent Governor Bill Walker has demonstrated in Alaska. When state revenues plunged because of low oil prices, Governor Walker salvaged the state finances by cutting the annual dividend paid to all Alaskans—long considered the third rail of state politics.

The Centrist “fulcrum strategy” in the U.S. Senate is about electing a handful of Centrist Independents who would wield disproportionate power from the center. This group would have the power to block the very worst ideas. But the fulcrum strategy cannot just be about obstruction; Americans have had enough of that.

In the case of the Republican tax plan, the process would be block and redirect. Block a massively irresponsible tax cut; redirect the discussion towards where bipartisan cooperation is essential: tax reform and entitlement reform.

Yes, passing out borrowed money to voters is much easier, but the whole point of the Centrist Project is to promote better governance. If we want different outcomes, we need to elect politicians who will rise above superficially attractive populist ideas.

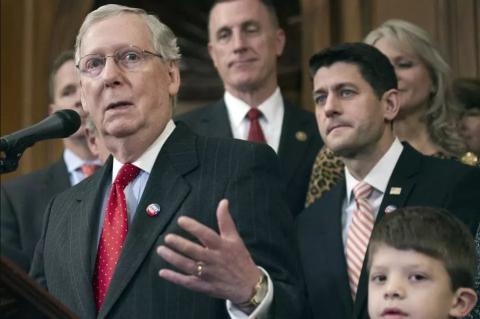

Photo Source: AP