The Committee for a Responsible Federal Budget (CRFB) came out with a new report on the risks of doing nothing to fix Social Security and provided several solutions that Democrats, Republicans, and those in-between, can agree on.

Social Security is fast becoming a casualty in the internal budgetary battles on Capitol Hill. Another casualty is the FY 2014 budget and the across-the-board discretionary programs that go with it. Fortunately, Social Security is not directly linked to those annual debates.

Both parties are playing poor brinksmanship (is there any other kind?) and those that believe Social Security does not need fixing in the long-term with present-day solutions, are either not paying attention or do not know any better.

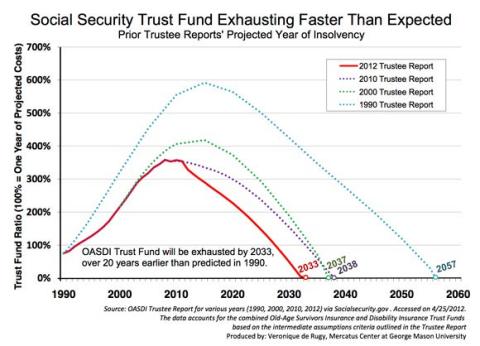

According to the actual trustee overseers of Social Security, the funds will run dry by 2033.

The combined OASDI [Old-Age and Survivors Insurance and Disability Insurance] trust funds have a projected depletion date of 2033, also unchanged from last year’s report. After the depletion of reserves, continuing tax income would be sufficient to pay 77 percent of scheduled benefits in 2033 and 72 percent in 2087.

The wrong way of looking at this dreaded scenario is that the problem is a few years away and the current system is not a priority worth fixing today. Some very important people feel that the problem is a generation or so away. The bottom line is they are wrong.

Kicking the problem down the road will not help the current generation as we will also be relying on the same funds in our retirement. If Democrats and Republicans are arguing over how to fund the government past the quickly approaching deadline, what is to prevent the status quo from being kicked further past 2032?

Something needs to be done and kicking the can should stop being the status quo. The very important decision-makers can make up their mind by listening to the next generation of leaders.

As with many solutions to fiscal problems, the government can tax more or cut spending or typically a combination of the two. In Social security terms, they increase the portion in your paychecks that goes to fund the entitlement program or cut benefits to current and future beneficiaries.

The CRFB lists four consequences of prolonging the inevitable:

- A 23 percent cut in benefits in twenty years. That is how much benefits must be cut for the program to remain solvent for 75 years. If that cut was due today, it would be only 16.5 percent.

- To prevent the real fear of insolvency from creeping up, payroll taxes will need to be raised 4.2 percent. That is a steep hike considering it is now 12.4 percent for employees and employers to share. The good news is that 4.2% hike will be required in 20 years. To fix it now would instill a 2.7% raise.

- The idea of chained-CPI to slow the growth of benefits to better account for retiree spending is losing its significance the closer we get to 2033. It will not be enough, only covering 20 percent of the gap, given the other circumstances.

- Another very common issue to understand when dealing with retirement is that you are working on a long-term plan. That means the earlier you start planning, the better your chances will be at accumulating more money for your own personal trust fund.

The Social Security system is a progressive system in that needs to be maintained through each generation. Every generation or so, the population expands and grows older effecting the number of beneficiaries. Inflation takes its toll on benefits. Wages, which benefits are indexed to, increase over time. Even as government is in constant transition with the focus either on taxing or cutting, the Social Security system needs to be reviewed.

In a good retirement plan, Social Security would not be the only income a retiree receives. If any of the current 162 million workers aiming for retirement knew what their Social Security benefit would be, they would be better positioned to plan for their years after work ends. That information could even help determine when their first retirement day is. However, that group of 162 million workers is just a portion of the people that will be affected by how Washington solves the current Social Security problems, if the solution is current anyway.

It makes better sense to maintain a constant eye on the system and not only make changes sooner rather than later, but not wait so long between changes in the first place. The benefit cuts, tax increases, and other fixes are only projected to prolong the solvency another 75 years. If the system gets fixed sooner, the solutions will cost less and the system will be stronger longer.

A version of this article first appeared on The Can Kicks Back blog.