source: finance.senate.gov

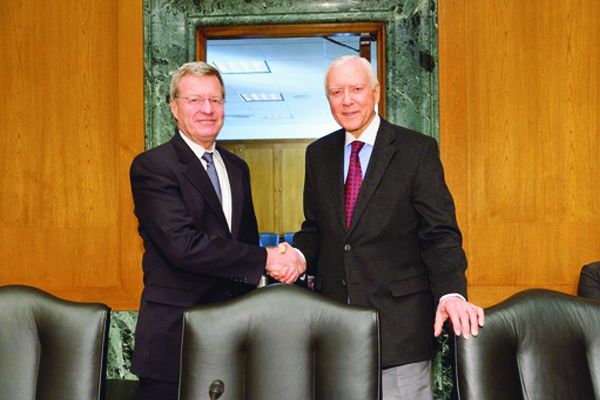

As negotiations on how to resolve the ‘fiscal cliff’ broil on, the Senate Finance Committee acts as a crucible to determine policy outcomes. The Finance Committee naturally maintains heavy influence over policy relating to taxes and entitlement programs and Chairman, Max Baucus (D-Montana), has revealed somewhat positive indications regarding fiscal cliff talks.

Baucus told local news affiliate KPAX:

“I expect good faith, because the election is over and more than that, members of Congress know what the problem is. They know we’ve got a huge big debt. It’s got to be chipped away at. They know we can’t go off this fiscal cliff and I think we’ll find a solution.”

The Hill has indicated that parts of Finance Committee member Ron Wyden’s (D-Oregon) “Bipartisan Tax Fairness and Simplification Act of 2011” are likely models for parts of a budget deal. The bill, cosponsored by Dan Coats (R-Indiana), would “[Create] a new 35 percent exclusion and a progressive rate structure for dividend and long-term capital gains income.”

This near 20 percent increase provides a significant revenue option for lawmakers. The Congressional Budget Office found that similar policies of increasing the capital gains rate could “raise revenues by a total of $10 billion from 2012 through 2016 and by $49 billion from 2012 through 2021.”

Regarding other aspects of a budget deal, Baucus has been pushing for rate hikes on the top 2% of Americans, but not necessarily for them to return to their pre-Bush levels of 36% and 39.6% for high earners.

Yet, Ranking Finance Committee Member Orrin Hatch (R-Utah) spoke out against raising tax rates on Fox News Monday:

“Well, we hope so, because none of us are for rate increases. We are for finding enough revenue to satisfy the president in the code itself. I think that's something we can do. But to raise the rates would hit a million small businesses and lose about 700,000 jobs.”

The details of a final budget overhaul are still unknowable, and congressional Republicans and Democrats largely remain split on raising tax rates for those earning over $250,000 a year. Baucus and the Democrats have shown some flexibility with regards to how high, but many Republicans remain unmoved.